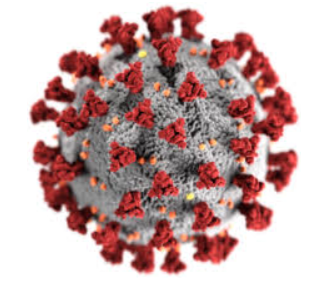

COVID-19 presents a significant threat not only to human health but also to business. For many businesses, likely moves by governments to contain the public health risk may result in a sudden fall in demand for your products or services, labour shortages and supply disruptions. As part of a comprehensive risk management strategy there are a range of actions you … Read More

Tax Tips for Small Business

Payroll As of 1 July 2018, business with at least 20 employees must use standard business reporting-enable software to report employee payments such as wages, PAYG and super. Single touch payroll will need to be utilised from 1 July 2019 for all businesses with less than 20 employees. Asset Write-Off The $20,000 Small Business Instant Asset Write-Off has been extended … Read More

Small Business News

Superannuation Guarantee Amnesty Although this Amnesty has not yet been passed into law it is wise to look into it. If and when it passes, this Amnesty will apply to employers who have either missed a SG payment or have not paid employees’ superannuation on time. What the Amnesty will do is provide employers with a one-off opportunity to correct … Read More